Talent Acquisition Strategy: Turn TA from Cost Center to Growth Driver

The State of Talent Acquisition in 2025

Let’s be honest: every Talent Acquisition leader heading into 2025 faces a defining question – what does your TA organization identify as? Is your team seen as a cost center to be squeezed, or a growth driver fueling business success? [SocialTalent, 2025] This isn’t just semantics. How you answer dictates whether you’re propelling your company forward or merely trimming costs to stay afloat. If calling your function a “cost center” makes you a bit nervous, good – it should. In a climate where CEOs plan to increase headcount by 92% to drive growth [KPMG, 2024], the stakes for Talent Acquisition (TA) have never been higher. It’s time to shift the narrative.

Let’s explore how to move from cost-cutting to value-creation in your talent acquisition strategy – backed by hard data, real stories, and a healthy dose of candor. By the end of this guide, you’ll see why TA is uniquely positioned to be a revenue engine for your organization, and how to start making that a reality. Ready to turn recruiting from an expense into an advantage? Let’s dive in.

The State of Talent Acquisition in 2025: From Transactional to Strategic

Here’s the current reality: Most companies still haven’t unlocked TA’s strategic potential. According to new research, only 34% of organizations view Talent Acquisition as a core strategic function – the rest see it as either a support or purely transactional function [iCIMS, 2025]. That means in two out of three companies, TA is still thought of as “just hiring people” rather than driving business outcomes.

Yet, paradoxically, HR leaders know they need to change this. In one survey, 88% of HR executives said they are driving strategic change through TA, but only 27% of their peers in IT (CIOs) agreed [iCIMS, 2025]. This glaring perception gap (imagine a bar chart with HR at 88% vs. CIOs at 27%!) underscores how Talent Acquisition’s value is not universally recognized in the C-suite. TA might be working harder than ever, but not everyone is convinced of its impact.

Meanwhile, the business context is raising the pressure. 75% of HR leaders plan to invest more in TA in 2025 [iCIMS, 2025], and 85% say talent acquisition technology is a higher priority now than two years ago [iCIMS, 2025]. CEOs, for their part, are betting on talent – nearly all are looking to grow their workforce and skill up their people for the future [KPMG, 2024]. In plain terms: companies want growth, and they know talent is the key, but they haven’t fully empowered TA to deliver that growth.

So, if you feel like your team is stuck fighting for budget or struggling to prove its worth, you’re not alone. The state-of-play is a mixed bag of ambition versus alignment. HR is stepping on the gas, but many organizations still have one foot on the brake. The message for 2025 is clear: TA can no longer afford to remain a back-office cost center. The business needs more – and if TA doesn’t step up, business leaders will find other ways to get what they need.

Incremental tweaks won’t close this gap. To truly change TA’s identity from transactional to strategic, we need to debunk some stubborn myths about what effective talent acquisition looks like today.

Myth-Busting: Why Traditional TA Playbooks Fail Now

The old recruiting playbook simply doesn’t work in 2025. The conventional wisdom for years was that TA’s job is to fill positions as quickly and cheaply as possible. Metrics like cost-per-hire and time-to-fill have been the holy grail. And yes, efficiency matters. But here’s the kicker: focusing solely on efficiency keeps TA stuck in the cost-center box. As one talent leader put it, too many TA teams were built just to “get rid of agency spend” and then measured on driving cost per hire down and time to hire faster – the wrong premise of what our value is [Recruiting Future, 2024]. When success is defined only by saving money, guess what? The business sees you as…well, just a way to save money, not make money.

In today’s environment, clinging to those old metrics is dangerous. Why? Because a purely transactional, “order-taker” recruiting function is increasingly likely to be automated away. Don’t take my word for it – one expert warned that the rise of AI is an “existential threat” to any function seen as easily transactional [Recruiting Future, 2024]. If all TA does is push CVs and cut costs, leadership might ask: why not just outsource it, or replace it with technology? That should send a chill down every recruiter’s spine. The traditional playbook not only fails to capture TA’s potential – it could make the function obsolete.

Let’s bust a few pervasive myths that are holding TA back:

| Myth | Reality |

| “Having fewer recruiters will save us money.” | Slower hiring costs money. When one TA leader had finance model the impact of cutting 14 recruiters, the company discovered it would lose millions in billable revenue due to unfilled roles. In short: fewer recruiters = longer vacancies = lost revenue. |

| “Missing one or two people won’t hurt the business.” | Even a single vacancy can hurt. At McDonald’s, being short just 1 crew member per restaurant cost hundreds of dollars per day in lost sales, adding up to millions annually. Small hiring gaps = frustrated customers = real money walking out the door. |

Here’s the truth: Metrics like cost-per-hire and time-to-fill, while useful for operational tuning, frame TA as a cost to minimize. They miss the bigger picture. Sure, in a high-pressure, low-margin environment like basic retail, obsessing over efficiency might keep you afloat. But in any organization where growth, innovation, or customer experience drive success, the old metrics fail to capture TA’s true value. If you’re still reporting only how much you saved on recruiting, you’re speaking the wrong language to the C-suite. As long as we play by the old rules, we reinforce the myth that TA is just a necessary expense.

It’s time to replace that outdated playbook. To break out of the cost-center trap, we need to start measuring and talking about what really matters: business outcomes. The next section lays out the new paradigm – treating TA as a growth engine – and how it fundamentally changes the way we operate.

A New Paradigm: Talent Acquisition as a Growth Engine

So, here’s what actually matters: revenue, profit, innovation – the lifeblood of your company. A modern talent acquisition strategy positions TA as a direct driver of these outcomes, not a back-office hiring service. The shift sounds simple (hire people -> company grows), but making it real means flipping our mindset and metrics. Instead of asking “How much did we spend on recruiting?”, we ask “How much revenue did our hiring enable or accelerate?” Instead of boasting about cutting cost-per-hire by 10%, we show how filling roles 10% faster helped launch a new product or capture extra sales. This is TA as a growth engine.

Let’s ground this in reality with a couple of examples from TA leaders who changed the game:

- Partner with Finance to Prove the ROI: Kevin Blair, a talent leader, faced a mandate to slash his recruiting team by 14 people to save costs. Rather than accept a false choice between budget and capacity, he flipped the script. Kevin asked Finance to calculate the revenue impact if roles stayed open longer with fewer recruiters. The data spoke volumes – cutting those recruiters would slow hiring so much that the business would lose a staggering amount in billable client work. When the CFO saw that lost revenue on paper, the debate was over. Kevin not only kept his team; he added headcount because he proved that investing in recruitment meant more money, not less. The lesson: Bring finance into the fold and speak their language (dollars and cents). When finance owns the metric, the business listens.

- Quantify the Cost of Gaps: At McDonald’s, former Global Head of TA Joshua Secrest wanted to show that talent issues hit the bottom line. He discovered that on days when a restaurant was short just one crew member, the location lost hundreds of dollars because customers walked away from long lines. Multiply that by thousands of restaurants and it totaled millions in lost revenue annually. That is a persuasive story. Joshua reframed a staffing “annoyance” as a revenue leak that needed plugging. His message to leadership: insufficient hiring isn’t an inconvenience – it’s a revenue killer. In the new paradigm, a vacant position isn’t just a line on a recruiter’s workload; it’s real revenue left on the table.

These examples underscore a simple truth: businesses care about revenue and profit above all else. Talent Acquisition drives value when it connects to those priorities. TA leaders who frame their impact in terms of dollars gained or lost are the ones who earn a seat at the table. As SocialTalent’s CEO Johnny Campbell put it, identifying as a value creator “requires a bold shift” – tying your TA metrics to business outcomes and proving TA’s role as a growth driver, not just a hiring function. In practice, this new paradigm means doing a few things very differently:

- Speak the language of the business. If revenue in your company is tied to, say, launching products faster or opening new stores, then talk about how hiring enables that. For example, rather than saying “we filled 50 sales roles,” say “those new hires will bring an estimated $5M in new sales this quarter.” Convert recruiting outcomes into the metrics the CEO and CFO care about.

- Understand your revenue drivers. Take the time to learn which roles or skills produce the most value in your organization. Is it revenue-generating salespeople? Innovators in R&D? Customer service reps who prevent churn? Focus your strategy there. Pinpoint the metrics that matter – maybe it’s customer acquisition rate, product launch timelines, or store coverage – and align hiring goals accordingly.

- Collaborate with Finance to quantify impact. Don’t guesstimate the business impact of hiring; partner with your Finance team to attach credible numbers to it. Whether it’s calculating the cost of vacancies (lost sales per unfilled role per week) or the upside of faster hiring (revenue brought forward by filling roles sooner), get Finance’s stamp on it. This not only boosts your credibility but also turns TA results into financial outcomes the CFO will champion. When you tie hiring metrics to profit or revenue – and Finance presents those numbers – suddenly TA isn’t a fuzzy “HR thing” anymore; it’s a business driver.

Bottom line, to transform TA into a growth engine, you shift from an efficiency mindset to an impact mindset. Efficiency is about doing things right; impact is about doing the right things for the business. That might mean, for instance, prioritizing a role that unlocks a new market over ten lower-value admin hires. It means celebrating your team not for saving $50K in recruiting costs, but for enabling $5 million in new revenue. This is a profound change in perspective. And it’s the only way forward.

Identify as a cost center, and your future looks like constant budget cuts and a marginalized role. Identify – and prove – that you’re a value creator, and you flip the narrative. TA becomes not just necessary, but indispensable for growth.

Now, the big question: How do you actually make this shift day-to-day? It’s one thing to agree philosophically, quite another to implement it across your team and stakeholders. Let’s break it down by role, because everyone in the TA ecosystem – from frontline recruiters up to the CHRO or CEO – has a part to play in turning talent acquisition into a true growth driver.

TA Managers: Connecting Recruiting Metrics to Business Outcomes

If you manage a TA team or function, you’re the crucial link between high-level business strategy and the day-to-day recruiting hustle. Your mission: translate business goals into talent goals, and vice versa. Here’s how you can drive the change:

- Reframe Your KPIs: Take a hard look at the metrics on your weekly dashboard. Are they all about efficiency (time-to-fill, cost-per-hire, recruiter capacity)? It’s fine to track those, but add outcome-oriented KPIs that tie to the business. For example, track vacancy impact – how much estimated revenue is lost due to open positions in key roles, and how much you’ve reduced that. Track quality of hire in business terms – maybe performance of new hires or their retention rate vs. legacy employees. One useful metric: Hiring ROI, which might combine speed, quality, and impact (e.g., “Our hiring of sales reps this quarter brought in $2M in new pipeline within 3 months”). When you present results to the exec team, lead with those outcome metrics. It changes the conversation from “we filled 20 roles” to “we enabled X outcome,” instantly making TA’s value clear.

- Educate Up and Down: As a manager, you need to evangelize this new paradigm both upward to executives and downward to your team. With the C-suite, start reporting in their language. Use finance-vetted numbers as we discussed. Don’t be afraid to say, “By cutting our time-to-fill by 10 days in Engineering, we estimate we saved about $200K in project delays” [HR Dive, 2025]. Paint the picture that links TA to money saved or earned. Conversely, be candid about risks: “Our vacancy rate in sales is 10% which could be costing us an estimated $1M a quarter in missed revenue – we need to address that ASAP.” Executives appreciate the candor and business framing. For recruiters on your team, train them to gather this kind of information and think this way. Share the stories of Kevin and Joshua with your team. Set expectations that recruiters come to kickoff meetings having researched the role’s impact. Make business impact a part of recruiter performance discussions (“How did your hiring this quarter help the business, beyond filling seats?”).

- Partner with Other Departments: Managers have a unique opportunity to break silos. The Kevin Blair story shows the power of partnering with Finance – you should do that routinely. Also consider aligning with Sales Ops or Business Unit leaders to forecast hiring needs not just by req count but by revenue plans. If sales wants to grow 20% next year, work backwards to hiring needs and get agreement that those hires equate to that growth. Suddenly, hiring targets become revenue targets – a shared goal. Collaboration with Learning & Development (L&D) or operations can also bolster your case; for instance, showing that without new hires, existing staff overtime costs go up or product development slows down. Gather allies around the idea that talent is a constraint or accelerator for every plan the company makes.

- Tell Resonant Stories: Data is vital, but humans are wired for stories. Arm yourself with narratives that bring your numbers to life. Perhaps it’s an internal example: “When we finally filled the head of E-commerce role after 6 months, the team hit record online sales in the next quarter – that delay likely cost us momentum.” Or external cases: mention how other companies have transformed TA into a profit center. For example, remind execs of the McDonald’s story – “Even one person short can hurt revenue” [SocialTalent, 2025] – and draw parallels to your business. These stories make the ROI of TA tangible and urgent. They answer the “so what?” behind your metrics.

TA managers essentially act as translators and strategists. You connect the dots between what the business needs and how talent delivers it. When you do this well, you stop being asked “Why do we spend so much on recruiting?” because you’ve already answered it: “Here’s the value we get.” Instead, leadership starts asking “Do you have what you need to hit our growth goals?” – which is exactly where you want to be.

Executives & HR Leaders: Championing TA as a Growth Lever

For HR executives, Chief People Officers, and any business leader overseeing talent acquisition: your role is to set the tone and invest for impact. The organization takes its cues from you on whether TA is just a hiring service or a strategic arm. Here’s how you can cement TA’s status as a growth driver:

- Make TA a Pillar of Strategy, Not an Afterthought: Include talent acquisition in strategic planning discussions, not just as a budget line. If the company is entering a new market or launching a product, TA should be at the table, mapping out how to supply the talent for that plan. As an executive, explicitly link talent goals to business goals. For example, state in your OKRs or strategy docs: “Increase market share in X – supported by hiring 50 specialized engineers by Q2.” When TA hires those engineers, celebrate that win in the same breath as the market share gains. This signals to all departments that hiring is inseparable from business success.

- Demand and Support the Right Metrics: Ask your TA leader to provide the kind of outcome-focused reporting we’ve discussed. If all you see are reports on cost and efficiency, push back. Say, “I want to know how hiring affected our project timelines, sales numbers, customer satisfaction, etc.” At the same time, support your TA team in developing the capability to get these metrics. Maybe they need better analytics tools or a data analyst – be willing to invest there. When you, as an executive, start quoting stats like “filling our critical vacancies 20% faster saved us $500K this year” in board meetings, you legitimize TA’s strategic role in a very public way.

- Foster Cross-Functional Alignment: Use your clout to break any silos between TA and other execs. If the CIO or CFO isn’t aligned with the TA vision, bring them into the conversation. The iCIMS survey showed a lack of alignment between HR and IT on TA’s strategic value [iCIMS, 2025]; don’t let that fester in your company. For instance, if you’re adopting new recruiting technology (AI tools, etc.), ensure the CIO is on board and sees it as part of the broader digital strategy, not just “HR’s toy.” Similarly, make hiring managers accountable partners. If a department is dragging its feet in interviews or keeping requisitions open too long, escalate that issue as a business risk. Executives need to hold other leaders to account: talent is a shared responsibility. When other departments experience the pain or gain of TA outcomes (like lost revenue from slow hiring), they’ll become your allies in improving the process.

- Invest in Capability Building: Turning TA into a growth driver might require new skills or roles – be ready to sponsor that. This could mean training recruiters in consultative selling or business finance (so they can speak the language of stakeholders), hiring a Talent Analytics specialist to crunch those ROI numbers, or bringing in an employer branding expert to attract higher-quality talent that fuels growth. These are not “nice to haves” – they are force multipliers for your talent strategy. Leading organizations are already doing this; they’re upskilling TA teams to interpret data and engage with the business at a deeper level. If you want TA to deliver big, equip them big.

Perhaps most importantly, champion the wins. When Talent Acquisition drives a positive outcome – say, a new store opening on schedule because the staff was hired on time, or a key executive hire who unlocks a new initiative – broadcast that story. In executive meetings, connect the dots explicitly: “Thanks to our TA team’s efforts, we were able to launch in Germany this quarter, which added $2M to revenue.” This not only reinforces TA’s value to your peers, it also motivates the TA team and shows everyone that leadership cares about talent as a top-line priority, not just a cost.

In short, executives must treat TA as you would any revenue-generating function. Set bold targets, invest in capabilities, measure ROI, and hold people accountable. When you do that, you legitimize the new paradigm from the top down. And believe me, that empowerment trickles down to every recruiter’s attitude and every hiring manager’s approach.

Empowering the Shift: Training as the Great Enabler

By now it’s clear that making TA a growth driver isn’t just a superficial change – it’s a skill and mindset transformation for the whole team. You might be thinking, “This sounds great, but do we have the people who can actually do all this?” That’s where training and development come in as the secret sauce.

The talent acquisition field has evolved so fast (think about the influx of AI, data analytics, new hiring models) that even seasoned recruiters and TA leaders are finding they need new skills. Business acumen, data literacy, consulting skills, stakeholder management – these are not traditionally taught in recruiter school (if only that existed!). To pivot your team from a service mindset to a strategic mindset, you need to invest in upskilling them.

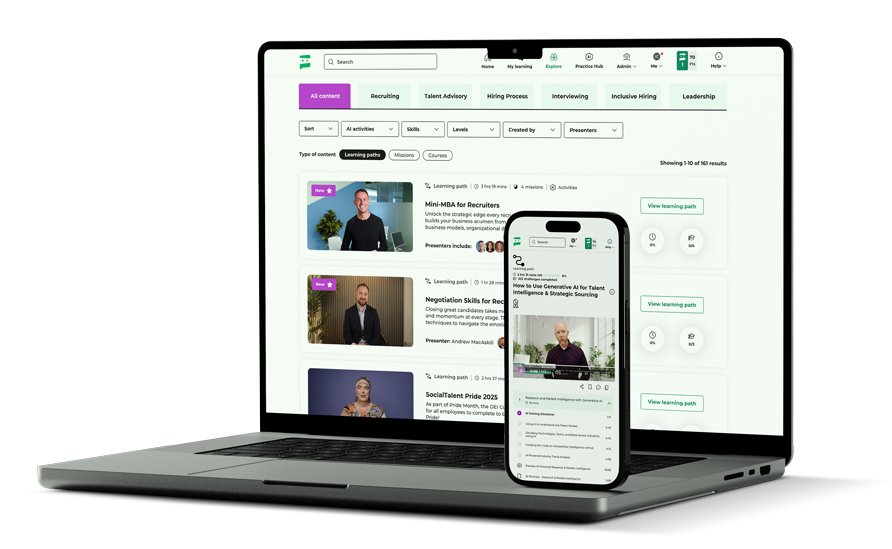

And look – we could list a bunch of training programs or platforms you might consider, but who are we kidding? You’re here on SocialTalent’s platform right now, and that means you already know the value of continuous learning. The key is to focus that learning on the areas that drive the new TA paradigm:

- Financial Literacy for TA: Ensure your team understands basic finance concepts and how the company makes money. A little finance 101 for recruiters can go a long way. When a recruiter can read a P&L or discuss ROI, they gain instant credibility with hiring managers and execs. There are courses and content (yes, on SocialTalent too!) geared towards HR/TA professionals learning to speak CFO-language.

- Data Storytelling: It’s not just about pulling reports; it’s about interpreting and presenting data persuasively. Train your team on how to craft a narrative from numbers. For example, learning how to analyze pipeline conversion rates or diversity metrics, and then recommend actions. When recruiters and TA managers can whip up a quick data-backed story (“Here’s what our hiring data says, and here’s what we should do about it”), leadership will listen.

- Consultative Skills: Recruiters often come from a service mindset – “the hiring manager is my customer.” In the new world, recruiters need to be comfortable consulting to their hiring managers as true partners. This can be taught! Role-playing challenging conversations, learning how to influence without authority, practicing how to say no (or yes) with a business rationale – all these skills can be honed through training workshops or e-learning modules. The result is a team that doesn’t passively take orders, but actively guides the hiring process toward the best outcome.

- Employer Branding & Candidate Experience: Driving growth means attracting top talent that will propel the business. Investing in training around employer branding, marketing skills for recruiters, and candidate experience optimization pays off in higher quality hires. It’s easier to drive revenue with great people on board, and great people join companies with compelling, authentic stories. Make sure your TA team knows how to sell the organization’s mission and growth opportunities – it directly affects who they can bring in.

As an organization, making time and budget for training signals that you expect more from TA and you’re willing to empower them to deliver more. If you’re a TA leader, lobby for that investment – tie it to the outcomes we’ve discussed (“If we want to improve hiring ROI, we need to deepen these skills…”). If you’re an executive, remember that every dollar spent on elevating TA’s capabilities can return many times over in better hires, faster fills, and stronger business alignment.

One more thing: embrace a culture of continuous learning in TA. The industry’s evolving too quickly to rely on yesterday’s knowledge. Encourage your team to read articles, attend webinars, get certifications – maybe even set up a monthly knowledge share where one recruiter teaches the rest something new they learned. This keeps everyone sharp and curious. And it sends a message that staying the same is not an option. The only thing that’s non-negotiable is motion – keep moving, keep learning.

Alright, we’ve covered the why and the how – from mindset shifts to role-specific actions to enabling skills. Now let’s consolidate all this into a handy checklist you can use to kickstart the transformation of your TA function.

From Metrics to Momentum: 2025 TA Strategy Checklist

It’s time to turn insights into action. Use this checklist as a roadmap for repositioning your talent acquisition strategy from cost center to growth driver:

- Audit Your Metrics: What are you measuring? Make sure you’re tracking outcomes, not just efficiency. (Are you only looking at time-to-fill and cost-per-hire, or do you also measure things like the revenue impact of filled vs. unfilled roles, quality of hire, and hiring manager satisfaction tied to performance?) If your dashboard doesn’t show how TA affects the business, reconfigure it.

- Build a Business Case with Finance: Don’t go it alone on numbers. Partner with your finance team to quantify the real cost of hiring gaps and the real value of hiring improvements. Develop models for cost of vacancy, ROI per hire, and scenarios for scaling the team. When finance validates the data, you’ll have rock-solid ammunition to secure budget and buy-in. (Example action: Ask your CFO or finance analyst to calculate how much revenue is lost each month a key revenue-generating role stays open.)

- Tell Stories That Resonate: Translate your data into narratives that hit home for leaders. Collect real examples from your company or industry that illustrate TA’s impact (or the cost of under-investment). Use them in presentations and discussions. (For instance: “Last year we struggled to hire in R&D and had to delay a product launch – that’s exactly what happened at Competitor X and it cost them market share. I don’t intend for us to repeat that.”) Stories + data = memorable insights.

- Engage Leadership Proactively: Don’t wait for execs to ask HR for input – proactively make the case that TA is a strategic lever for growth. This means regularly reporting to the C-suite on talent risks and opportunities, integrating hiring plans with business plans, and speaking up if goals are unrealistic given talent supply. Educate your executive team on what’s needed to hire the talent that drives their objectives. When you secure a big win (like Kevin Blair did), share that success widely and attribute it to the partnership between TA and the business. Over time, aim to have at least one TA metric on the company’s primary KPIs. That’s a sure sign TA is now viewed as business-critical.

(Keep this checklist handy in your 2025 planning sessions. Consider it your “cost-center to value-driver” scorecard. If you can tick off all four items, you’re well on your way to changing the narrative around TA in your organization.)

The ROI: Why Transforming TA Pays Off

Let’s bring it home with the numbers that matter. Transforming TA from a cost center to a growth driver isn’t just a feel-good exercise – it delivers tangible ROI. Consider a few headline stats and outcomes:

- Revenue Gains from Full Staffing: We saw how just one extra hire per McDonald’s restaurant led to hundreds of dollars more per day in sales [SocialTalent, 2025]. Scale that up and the revenue impact is huge. Fully staffed teams hit their targets; understaffed teams leave money on the table. In other words, each critical hire is an investment that yields returns – sometimes exponentially.

- Cost of Inaction (or Delayed Action): Every day a revenue-generating role stays vacant is lost income. If a salesperson has an average quota of $500K/year, one empty territory can mean roughly $1,370 of lost revenue per day. Multiply by the days or weeks that role is open, and it far outweighs the cost to recruit a great candidate a bit faster. This is why accelerating time-to-fill for key roles directly boosts the bottom line. Hire faster, earn faster.

- Cost of a Bad Hire: On the flip side, making the wrong hire has serious costs. The U.S. Department of Labor estimates a bad hire can cost up to 30% of that employee’s first-year earnings [Ferretly, 2023]. For a $100K position, that’s a $30K hit – and that’s just direct costs, not counting team disruption or lost opportunities. By focusing on quality of hire and cultural fit (enabled by better assessment, training, and employer branding), TA saves the organization from these expensive mistakes. Fewer bad hires = immediate and significant cost savings.

- Improved Productivity and Innovation: Strategic TA isn’t only about revenue; it’s also about enabling productivity and innovation gains. For instance, a tech firm that staffed its engineering team quickly and effectively might launch new features 20% faster than last year – capturing market share and customer spend earlier. Or consider employee retention: hiring people who truly fit and succeed means less turnover. If you reduce regrettable turnover in key roles, you’re saving potentially 6-9 months of salary in rehire and retraining costs per vacancy. These are real, measurable returns from smarter talent acquisition.

- Stronger Competitive Position: Finally, there’s an intangible but critical ROI: market agility. Companies that treat TA as strategic can scale up or pivot faster when new opportunities (or crises) arise. Did a competitor suddenly go bust, freeing up a pool of talent? A sharp TA function in “growth driver” mode will swiftly snag those A-players and boost your company’s prowess. Did your company decide to enter a new region? A strategic TA team will have talent pipelines ready, turning a strategic decision into operational reality faster than rivals. This agility translates into dollars through first-mover advantages and smoother expansions.

In short, investing in a strategic TA function yields a triple dividend – you increase revenue, decrease hidden costs, and strengthen organizational capability. It’s the kind of ROI that should make even the most hard-nosed CFO smile. No longer is Talent Acquisition just a line item to control; it’s a lever to pull for growth. The data is compelling, and so is the logic: how could fueling your company with the right people, at the right time, for the right initiatives not pay off?

Here’s what it all comes down to: Talent Acquisition can either be a drag on growth or a driver of it. And that choice is ours. The companies that win in 2025 and beyond will be those that recognize people are not just a cost – they are the engine of everything. They’ll be the ones who say “Growth is the job,” and empower their TA teams accordingly. So ask yourself and your organization the question once more: What does our TA team identify as? If the honest answer isn’t “a growth driver”… well, you have a roadmap here to change that. The sooner you start, the sooner you’ll see the payoff. Let’s make this the moment TA finds its true voice – and uses it to not only earn a seat at the table, but to drive the whole business forward.

References:

- [SocialTalent, 2025] Campbell, J. (2025). Redefining Talent Acquisition in 2025: From Cost Center to Value Driver. SocialTalent Blog.

- [iCIMS, 2025] iCIMS (June 4, 2025). New iCIMS Research Uncovers C-Suite Misalignment on the Strategic Value of Talent Acquisition (Press release).

- [HR Dive, 2025] Crist, C. (2025). CHROs, CIOs disagree on the strategic value of talent acquisition. HR Dive.

- [Recruiting Future, 2024] Alder, M. (2024). Ep 640: What Is The Value Of TA? (Podcast transcript with Toby Culshaw). Recruiting Future.

- [KPMG, 2024] KPMG (2024). 2024 Global CEO Outlook: CEO’s are betting big on AI and talent.

- [Ferretly, 2023] Ferretly (2023). The High Cost of Turnover and Toxic Hires.